Commercial real estate (CRE) is evolving faster than ever, and investors who understand current trends can maximize returns. From office space to retail properties and industrial real estate, the 2025 market is defined by flexibility, experience-driven design, and sustainability.

Evolving Office Space Demand

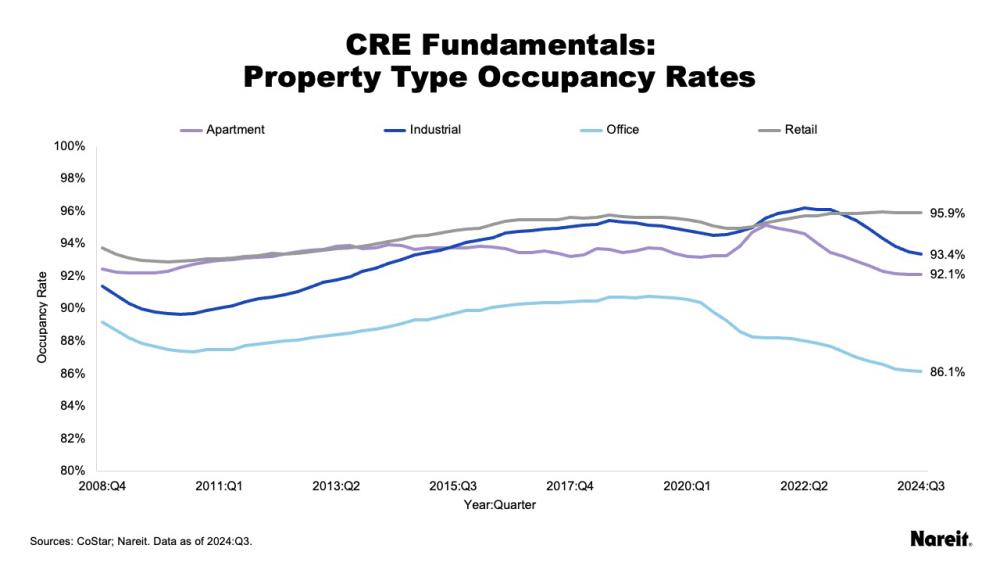

Hybrid work continues to transform office leasing. According to a CBRE report, 62% of companies plan to reduce office footprint, while focusing on collaborative, amenity-rich spaces. Investors are increasingly targeting Class A office buildings in urban hubs, which have seen 10–15% higher occupancy rates compared to traditional spaces.

Case Study: Salesforce Tower in San Francisco renovated common areas and added flexible collaboration zones, increasing tenant retention by 20% and boosting rental income.

Retail Real Estate Reinvented

E-commerce has reshaped the retail property market, yet experiential retail is thriving. ShopperTrak reports that experience-focused stores see 35% more foot traffic than traditional retail-only outlets. Mixed-use developments, boutique shops, and destination retail drive engagement and support long-term lease stability.

Example: The Westfield Century City redevelopment in Los Angeles integrated dining, entertainment, and pop-up spaces, increasing sales per square foot by 18% within a year.

Industrial Real Estate Growth

Industrial real estate is booming thanks to e-commerce and logistics demand. Prologis reports that U.S. warehouse vacancy rates dropped to 4.3% in Q1 2025, with rental rates rising nearly 8% year-over-year. Distribution centers and last-mile delivery hubs offer strong, reliable cash flow for investors.

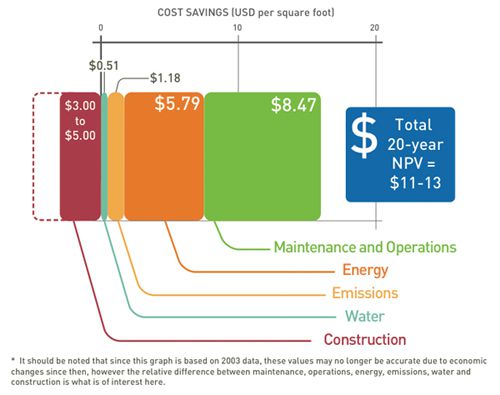

Sustainability and Green Investments

Sustainable practices in commercial real estate investing are increasingly important. Energy-efficient designs, LEED-certified buildings, and eco-friendly operations lower costs and appeal to tenants. Investors who integrate sustainability into their strategy benefit from improved long-term value and market competitiveness. Buildings with LEED certification or energy-efficient upgrades see 15–20% lower operating costs and attract high-quality tenants. Investors increasingly prioritize ESG-aligned CRE for long-term value.

Successful commercial real estate investing requires anticipating how businesses and communities use space. By monitoring CRE trends, focusing on adaptable office, retail, and industrial properties, and prioritizing sustainability, investors can unlock opportunities and maximize returns in 2025 and beyond.

Leave a comment